Irs Payroll Calendar 2022

Irs Payroll Calendar 2022

Pay Period Calendar 2022. Pay Period Calendar 2021. Use the 2022 Tax Calculator. Client Services HR Client Services.

Personal Finance Calendar For 2021 Charles Schwab

Use the Employers Tax Calendar later.

Irs Payroll Calendar 2022. Income Tax Formulas Other Publications Brochures Electronic Distribution Processing Tips. Pay by due date else no deduction of employee contribution 15052021. TDS Certificate-Form 16 A new format for Form 16 has been notified by the CBDT Central Board of Direct Taxes which is the salary TDS certificate Read more to the employee with concern to the given salary for FY 2021-22.

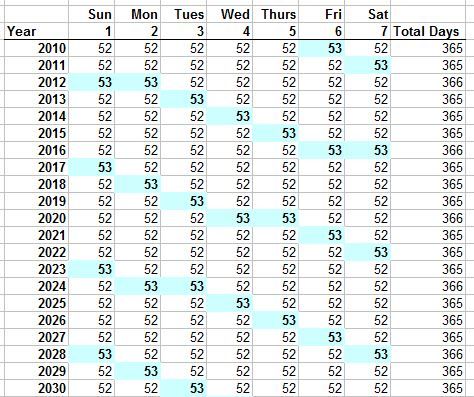

2001-2002 2002-2003 2003-2004 2004-2005 2005-2006 2006-2007 2007-2008 2008-2009 2009-2010 2010-2011 2011-2012 2012-2013 2013-2014 2014-2015 2015-2016 2016-2017 2017-2018 2018-2019 2019-2020 2020-2021 2021-2022 2022-2023 2023-2024 2024-2025 2025-2026 2026-2027 2027-2028 2028-2029 2029-2030 2030-2031 2031-2032. Downloadable calendars for fiscal and calendar year pay schedules. Any payments or deposits you make before January 3 2022 are first applied against the first 50 of the deferred employer share of social security tax and then applied against the remainder of your.

Due date for e-filing of annual statement of reportable accounts as required to be furnished under section 285BA1k in Form No. Pay Date Advanced Due to Holiday No Health Plan deductions taken TDHPF 051920 CENTRAL PAYROLL BUREAU UNIVERSITY OF MARYLAND PAY SCHEDULE FISCAL YEAR 2022 IPublicCritical FilesOperationsPayroll SchedulesFY2021UM Payroll Schedule. If you must pay excise taxes use the Excise Tax Cal-endar later.

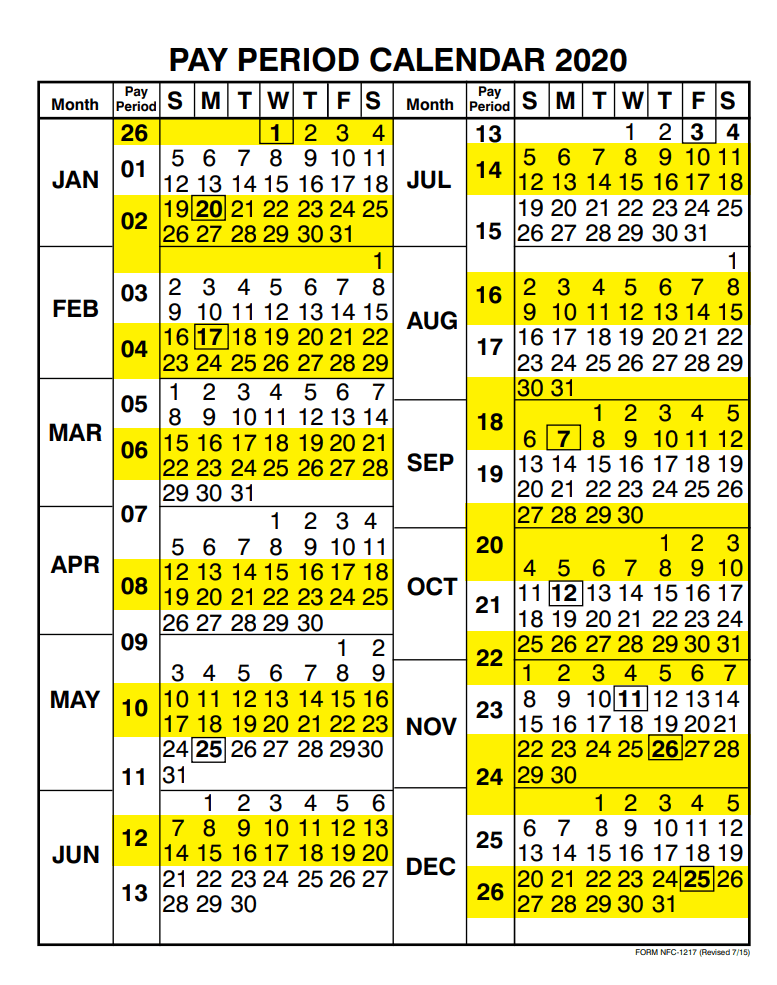

Pay Period Calendars Tax Information Taxes US. Fiscal and Calendar Year Pay Calendars. IRS Income Tax Forms Schedules and Publications for Tax Year 2022 - January 1 - December 31 2022.

Payroll Tax Calendar 2021 Select a tax year. If the employer deferred paying the employer share of social security tax in 2020 pay 50 of the employer share of social security tax by January 3 2022 and the remainder by January 3 2023. 20192020 tax year calendar.

Electronic Challan cum Return ECR. The due dates for. Tax Calendar Month and Week Month 1 Month 2 Month 3 Month 4 Month 10 Month 11 Month 12 Month 5 Month 6 Month 7 Month 8 Month 9 2021 2022 Payroll consultancy Payroll outsourcing Automatic enrolment Office.

Here Are Key Tax Due Dates If You Are Self Employed Forbes Advisor

Solved How Does Qb Handle 27 Pay Periods In 2020 For Sala

Key Deadlines For 2021 Q1 Tax Calendar Yeo And Yeo

/01January2021-249fe0cb9a524645a328c01275e70fc6.jpg)

2021 Personal Finance Calendar

Income Tax Due Dates For Fy 2021 22 Ay 2022 23 Cacube

When Will I Get My Income Tax Refund 2021 Cpa Practice Advisor

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment Cnet

Tax Season 2021 New Income Tax Rates Brackets And The Most Important Irs Forms

Government Pay Period Payroll Calendar 2021 Payroll Calendar

Post a Comment for "Irs Payroll Calendar 2022"