2022 Federal Beer Excise Tax Calendar

2022 Federal Beer Excise Tax Calendar

Beer brewed or imported in excess of the six-million-barrel limit continues to be taxed at 18 per barrel. - Tuesday April 6 Submissions and imported supplier quotes due by 4pm for April 26 change. The federal excise tax rates are now. The most significant of these is the permanent reduction of existing federal excise tax rates for small breweries distilleries and wineries.

Coronavirus Covid 19 Kpmg Global

Beer produced and removed by a domestic brewer who produces 2000000 barrels or less per calendar year.

2022 Federal Beer Excise Tax Calendar. The change in excise tax has no impact on the retail price as domestic beer is purchased excise paid If a change in price is desired please submit the Beer Price Submission form. 94529 reduced the excise tax on beer for small brewers to 7 per barrel on the first 60000 barrels produced in the United States and removed for sale or consumption or sale during the calendar year the reduced rate to be applicable only to brewers producing no more than 2 million barrels of beer in a calendar year and inserted provision that if several brewers are members of a controlled group the. 9-2018 dated January 4 2018 will be replaced with BIR Form No.

Breweries that were registered with the FCA before 31 December 2020 and declare beer tax annually. Submissions accepted for May 3 retail effective. An act to.

The PATH Act amendments to the IRC authorize a new annual tax return period. The Consolidated Appropriations Act 2021 CAA 2021 was passed by Congress and signed into law by the President on December 27 2020. The Tax Cuts and Jobs Act passed by Congress in December 2017 provided a temporary reduction in federal excise taxes for all brewers and beer importersCongress made these rates permanent at the end of 2020.

The FCA will send more detailed information on the registration process by post in the second half of 2021. CAA 2021 includes federal tax law changes in a part of. ALCOHOL Tax Rates for Calendar Years 2018 to Present view Historic Tax Rates BEER Reduced Tax Rates on Domestic Removals or Imports 2018 to Present Barrels per Calendar Year.

Introduced by Senator Allen. Beer Canada calls on the government to roll-back the April 1 tax increase in the upcoming budget. Beer containing Effective April 1 2021 April 1 2020 to March 31 2021 April 1 2019 to March 31 2020 April 1 2018 to March 31 2019 March 23 2017 to March 31 2018.

Excise tax rates were temporarily reduced for calendar years 2018 and 2019 with the CBMA provisions of the Tax Cuts and Jobs Act of 2017. In the case of small brewers such brewers are taxed at a rate of 350 per barrel on the first 60000 barrels domestically produced during a. Beginning in 2022 processors must meet minimum processing.

How Alcohol Taxes Figure Into Your Margarita Day Celebration Don T Mess With Taxes

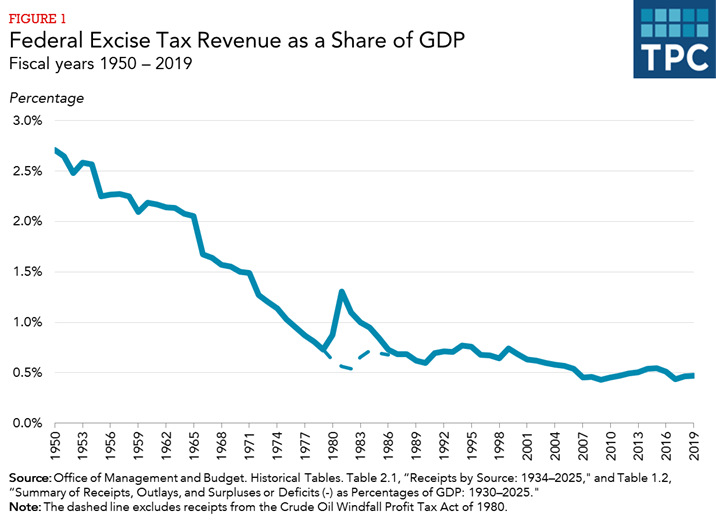

What Are The Major Federal Excise Taxes And How Much Money Do They Raise Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

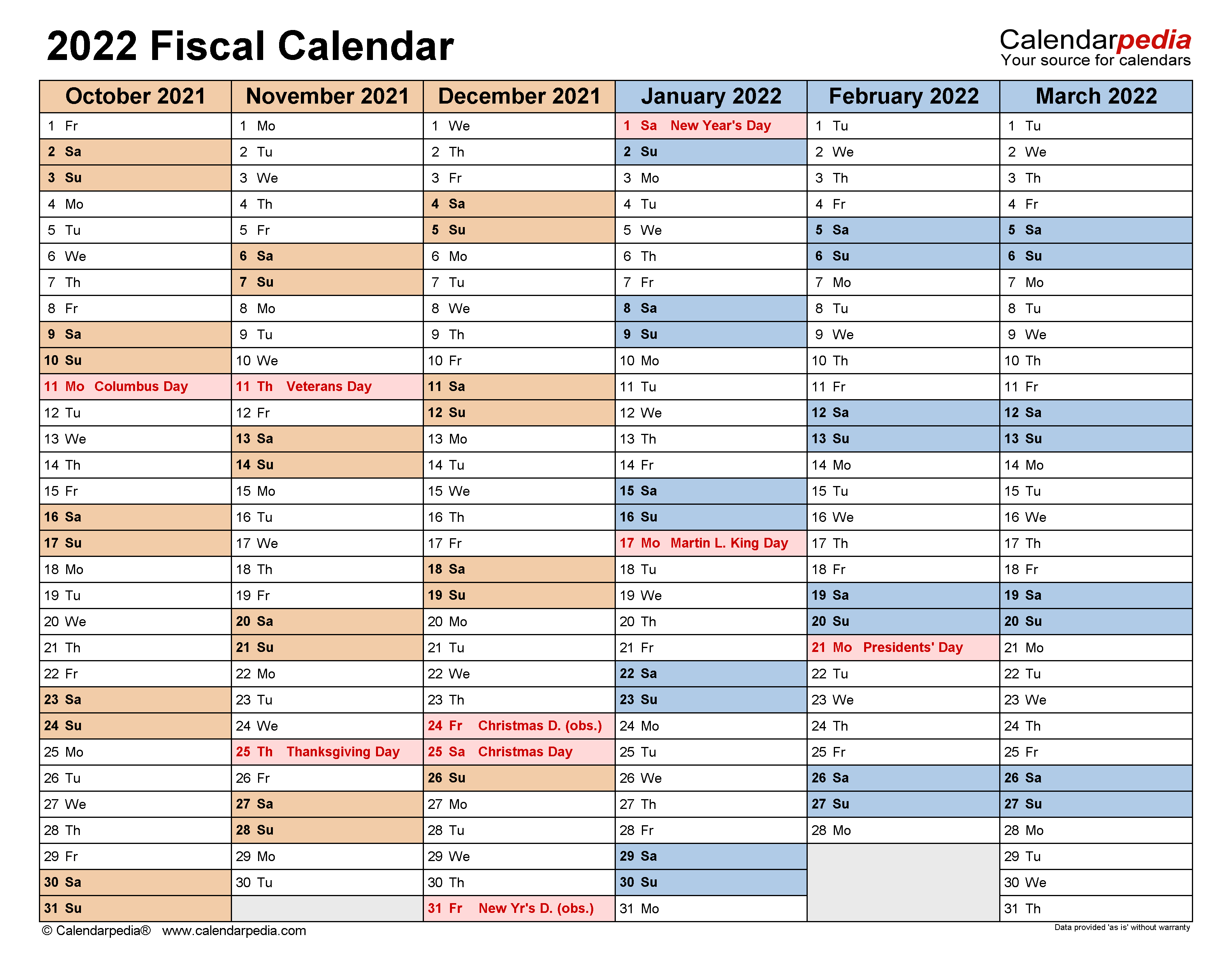

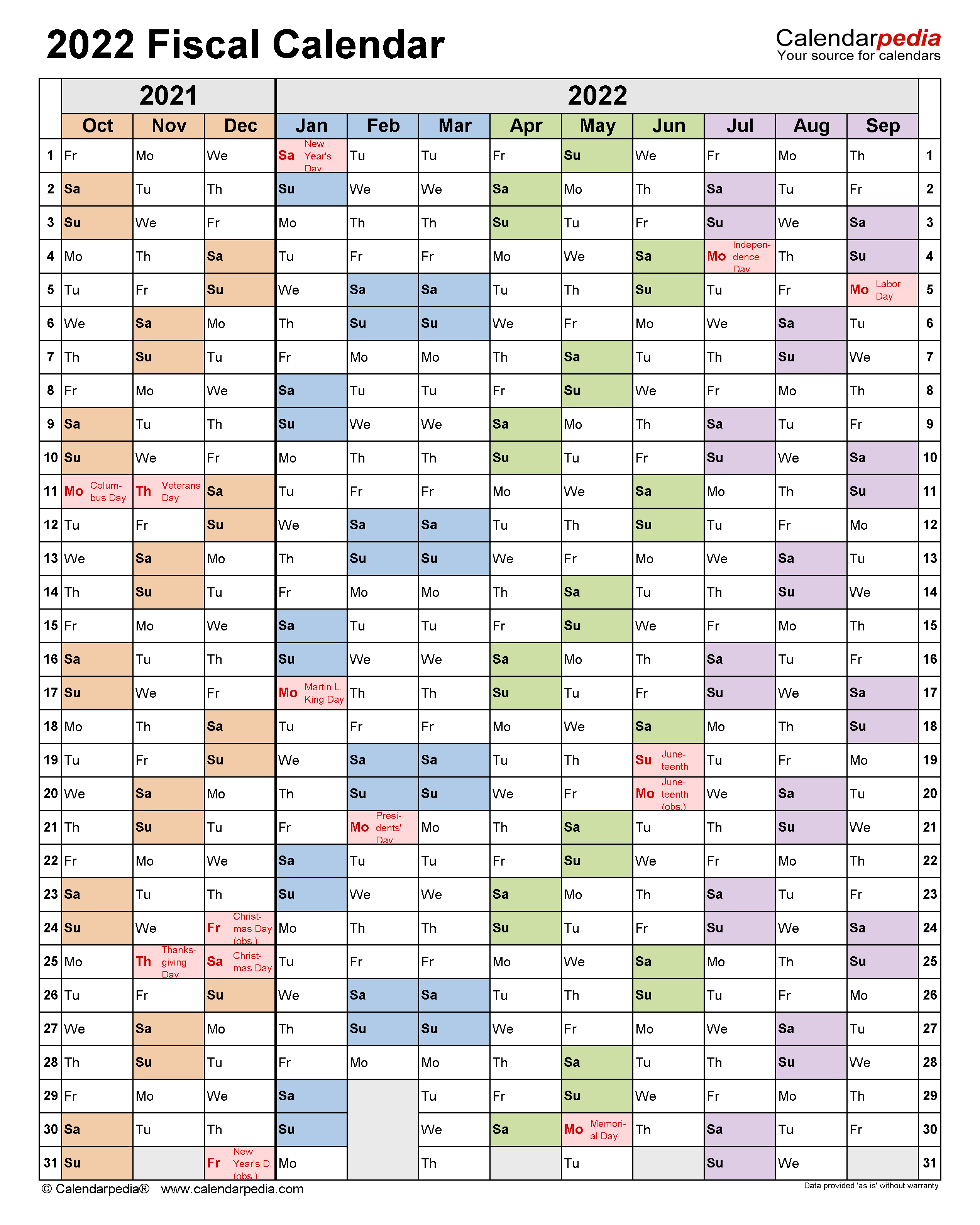

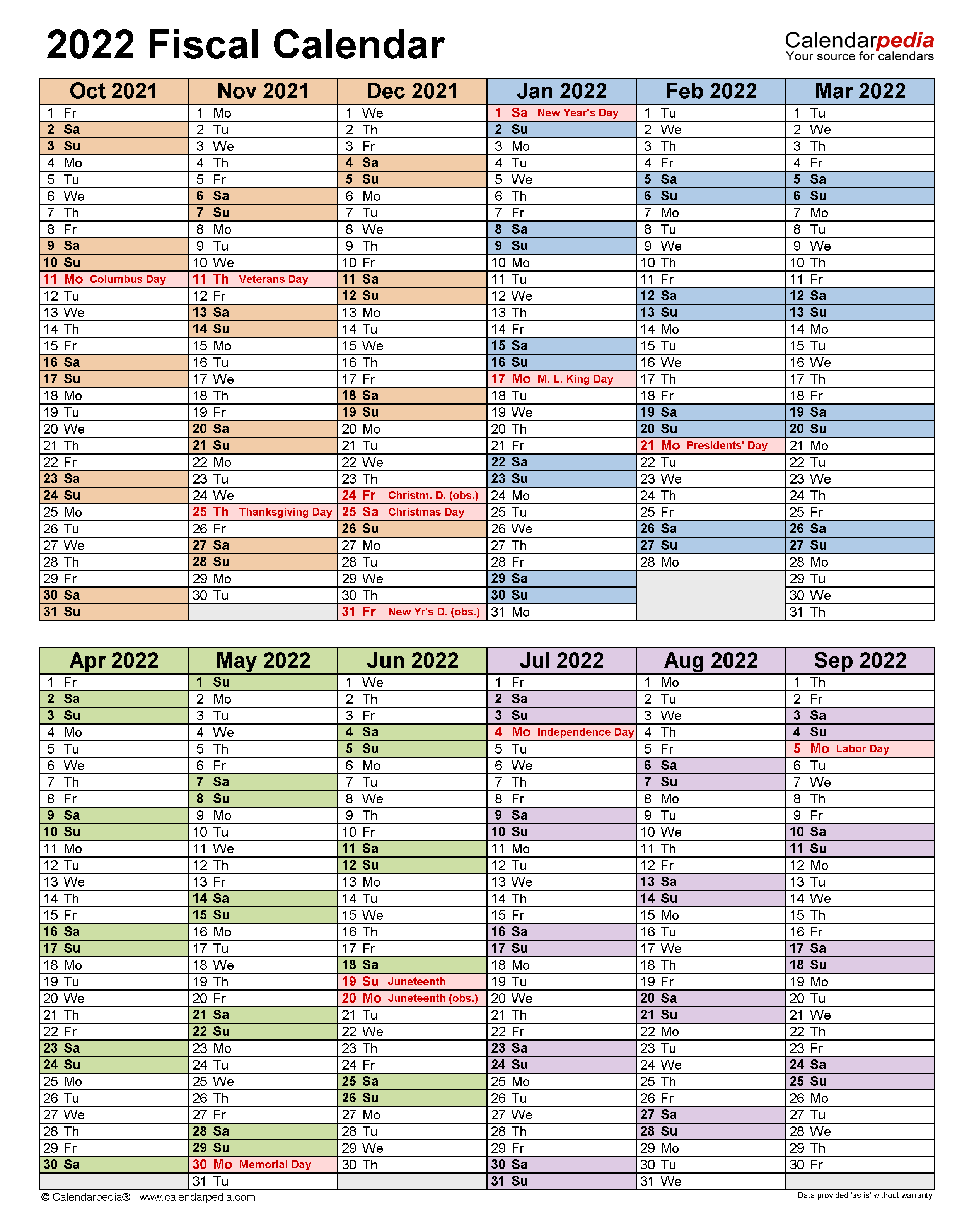

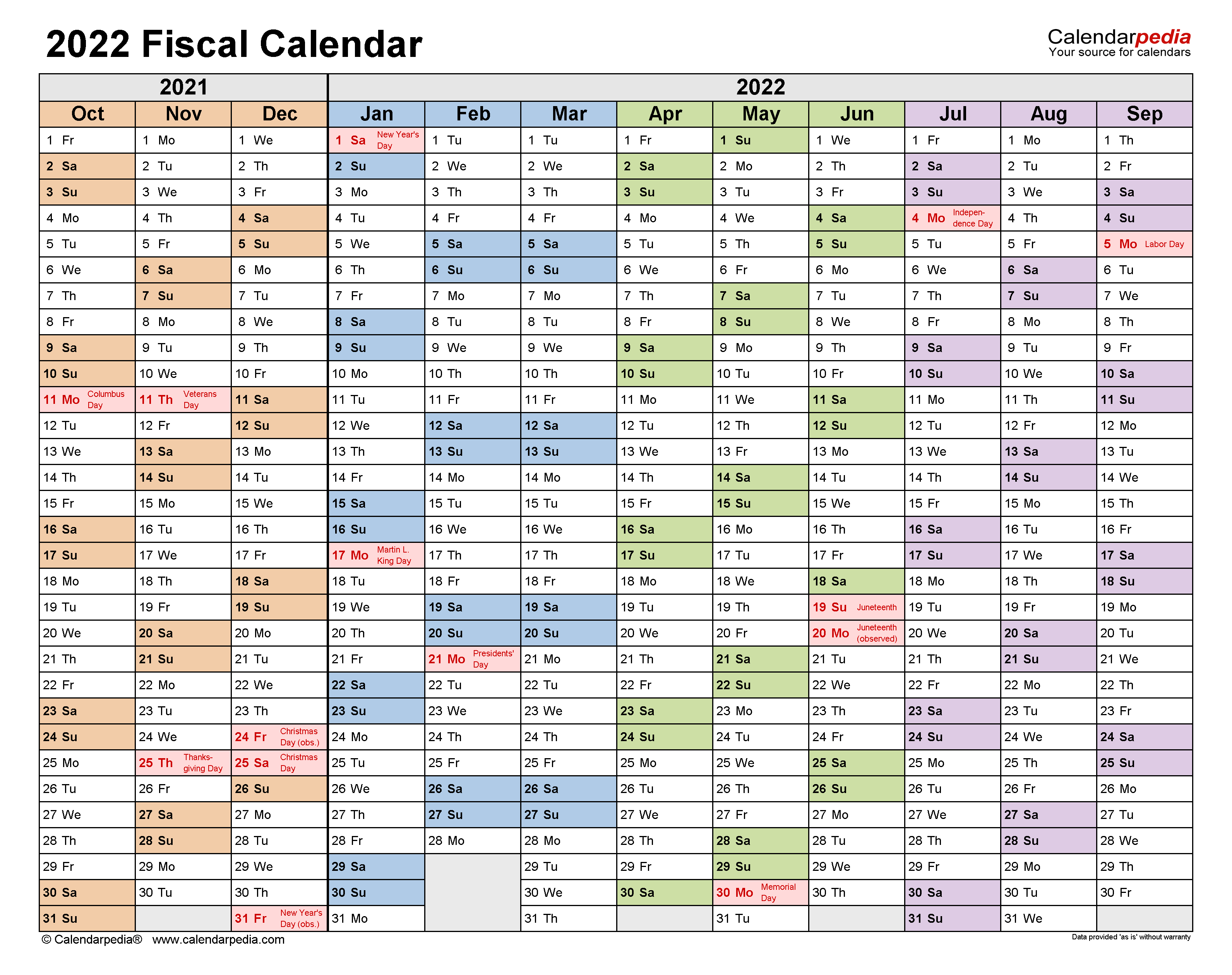

Fiscal Calendars 2022 Free Printable Pdf Templates

2022 Fiscal Year Calendar Templates Calendarlabs

Fiscal Calendars 2022 Free Printable Pdf Templates

Fiscal Calendars 2022 Free Printable Pdf Templates

Fiscal Calendars 2022 Free Printable Pdf Templates

Fiscal Calendars 2022 Free Printable Pdf Templates

Post a Comment for "2022 Federal Beer Excise Tax Calendar"